What is Delta Factors?

Understanding Investment Performance Behaviour

- Quantitative analysis that demonstrates performance behaviour and risk drivers of managed funds across all asset classes with the Australian industry

- Delta Factors uses the following framework to determine performance drivers

Delta Factors compliments qualitative research and performance results to provide a deeper understanding of what truly drives the risks of various managed fund strategies. This ensures your manager selections are more aligned to your investment philosophy and desired portfolio outcomes.

How can Delta Factors help?

More efficient portfolio construction

- Does my chosen strategy reflect the desired asset class exposure?

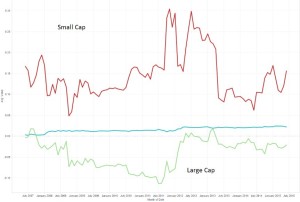

The following chart shows the Australian equity market exposures of more than 250 long-only Australian equity strategies over 11 years…the variations are enormous which begs the question…do your preferred managers increase or decrease your portfolio risk? Which strategies are best aligned to asset allocation goals?

Performance-based Style and Risk Factor analysis

- Are my strategies “true to label”?

- Which strategies blend best together?

- What is the specific role of a chosen strategy?

The following chart shows the relative exposure to small companies and large companies of three equities based strategies…one of them has significant small cap exposure but markets itself as a “Core” manager

Risk-adjusted Skill assessment

- When do various strategies perform best?

- Is outperformance due to style, market exposure, or security selection?

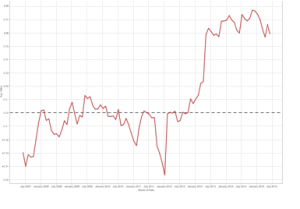

The following chart shows a multi-award winning strategy’s added value after removing all systematic factors such as market risk and style risks. Whilst recent added-value has been strong, the same can’t be said in preceding years.

Portfolio risk contribution

- Is my strategy an index hugger?

- Is success or failure due to smart-beta or passive risk factor exposures?

- Is the strategy truly benchmark agnostic?

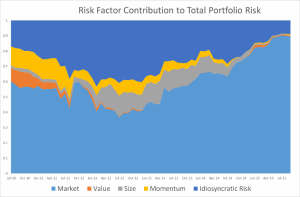

The next chart shows the breakdown of total portfolio risk of an actively managed equities strategy. It shows how the risks have shifted from a combination of market, smart betas (e.g. value, size, momentum), and active bets (idiosyncratic risk) towards a market-risk dominated fund.

Delta Factor subscription

There are 2 services available for subscription…

1. Delta Research

- Delta Factors online – secure access to analysis covering Australian managed fund universe of all equity-based strategies

- Updated quarterly

- Telephone and email support

2. Delta Advisory

- Delta Research service

- Delta Factors Product sheets

- Customised to Approved Product Lists and/or Model Portfolio List of funds

- Customised multi-product analysis and reporting that enables peer-to-peer comparison

- Available for all asset classes and strategies with track records longer than 3 years

- Portfolio construction assistance and ad-hoc consulting support

- Telephone and email support

Contact Delta

To find out more about Delta Factors, please contact Michael Furey on +61 (0)432 002 472 or email at michael.furey@deltaresearch.com.au